How Pkf Advisory Services can Save You Time, Stress, and Money.

5 Simple Techniques For Pkf Advisory Services

Table of ContentsGet This Report about Pkf Advisory ServicesPkf Advisory Services Fundamentals ExplainedAbout Pkf Advisory ServicesAll about Pkf Advisory ServicesThe Facts About Pkf Advisory Services Revealed

Most individuals these days know that they can not rely upon the state for even more than the outright fundamentals. Preparation for retired life is an intricate organization, and there are various alternatives readily available. An economic consultant will certainly not just aid filter via the several rules and item alternatives and aid create a profile to increase your long-term potential customers.

Purchasing a home is among the most costly decisions we make and the large majority of us need a home mortgage. A financial adviser might conserve you thousands, particularly sometimes such as this. Not only can they choose the most effective rates, they can aid you examine sensible levels of borrowing, make the many of your down payment, and may also find lenders that would certainly otherwise not be readily available to you.

5 Easy Facts About Pkf Advisory Services Shown

A monetary adviser understands exactly how items operate in different markets and will recognize possible disadvantages for you along with the prospective benefits, so that you can after that make an enlightened choice about where to spend. When your risk and investment assessments are total, the next step is to consider tax; also the many basic introduction of your setting might help.

For much more difficult plans, it might mean moving properties to your spouse or kids to increase their personal allowances rather - PKF Advisory Services. An economic adviser will constantly have your tax setting in mind when making referrals and factor you in the ideal instructions also in complicated scenarios. Even when your financial investments have been placed in area and are running to strategy, they should be kept an eye on in instance market growths or abnormal events push them off course

They can examine their efficiency versus their peers, ensure that your possession appropriation does not become distorted as markets vary and assist you combine gains as the target dates for your ultimate goals move closer. Money is a challenging topic and there is whole lots to consider to safeguard it and make the most of it.

Not known Facts About Pkf Advisory Services

Utilizing a great monetary consultant can cut through the hype to steer you in the best direction. Whether you require basic, functional advice or a specialist with devoted proficiency, you could discover that in the long term the cash you purchase experienced advice will be paid back often times over.

Keeping these licenses and qualifications calls for continual education and learning, which can be expensive and lengthy. Financial consultants need to stay upgraded with the most up to date sector patterns, guidelines, and finest practices to offer their clients successfully. In spite of these difficulties, being a certified and licensed economic consultant supplies enormous advantages, including countless profession possibilities and higher gaining potential.

The 6-Second Trick For Pkf Advisory Services

Empathy, analytical abilities, behavior finance, and excellent communication are vital. Financial advisors function carefully with customers from diverse histories, assisting them navigate complicated financial decisions. The capacity to listen, recognize their special demands, and provide tailored guidance his explanation makes all the difference. Remarkably, previous experience in financing isn't constantly a requirement for success in this area.

I started my job in company money, moving and upwards throughout the corporate money framework to refine abilities that prepared me for the function I remain in today. My option to move from corporate finance to individual money was driven by individual needs as well as the desire to help the lots of individuals, households, and little services I presently offer! Achieving a healthy work-life balance can be challenging in the early years of a monetary expert's profession.

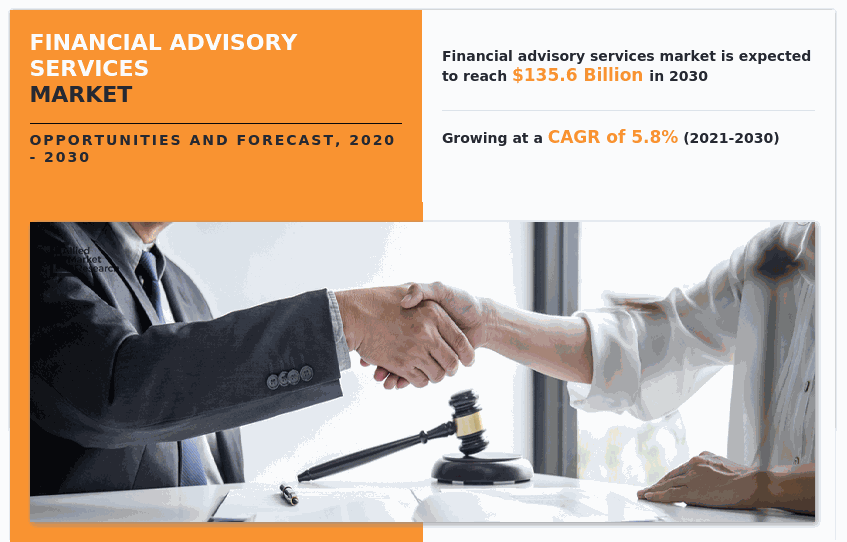

The financial consultatory profession has a favorable outlook. This growth is driven by variables such as an aging populace requiring retired life planning and boosted awareness of the value of financial planning.

Financial experts have the distinct capacity to make a considerable effect on their clients' lives, assisting them attain their monetary objectives and safeguard their futures. If you're passionate concerning finance and assisting others, this career path may be the perfect fit for you - PKF Advisory Services. To find out more information regarding becoming a monetary consultant, download our comprehensive FAQ sheet

More About Pkf Advisory Services

If you our website would like investment advice concerning your particular facts and conditions, please speak to a certified monetary expert. Any type of investment entails some degree of risk, and various types of financial investments include varying levels of risk, consisting of loss of principal.

Past efficiency of any type of safety and security, indices, strategy or allowance may not be a sign of future outcomes. The historical and present details as to policies, laws, guidelines or advantages contained in this paper is a recap of information acquired from or prepared by various other sources. It has not been individually verified, yet was obtained from sources thought to be dependable.

An economic advisor's most beneficial asset is not expertise, experience, or even the capability to generate returns for clients. It's depend on, the structure of any effective advisor-client connection. It sets a consultant aside from the competitors and maintains clients returning. Financial professionals throughout the nation we spoke with concurred that trust is the crucial to constructing long lasting, efficient partnerships with clients.